Reversing Items

After you have entered a trust transaction it can’t be undone, so if you make a mistake you will need to ‘reverse’ the data you entered in SILQ. A Trust Receipt or Withdrawal and/or Controlled Money Receipt or Withdrawal cannot simply be deleted. Each mistake must be reversed rather than deleted, so that an audit trail is continuous.

To complete a Reverse Item entry, firstly you must search for the item you wish to reverse.

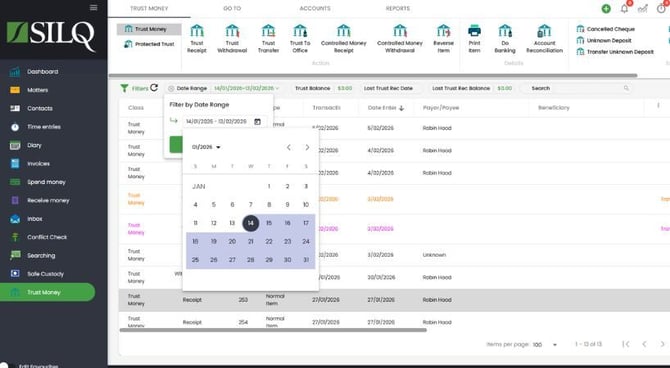

To do this, navigate to the Trust Money window by clicking on the Trust Money button in the Favourites Bar. This will bring you to the Trust Money window.

Once you are in the Trust Money window from the Display options section on the top left hand side of the screen, click the Date Range to drop down to locate the item.

Refer to this article to see how to reverse the item.