Initial Trust deposit and Starting Balance

In order to establish your initial trust deposit and starting balance, the first step is to add all your Matters and Contacts into SILQ. To learn how to do this, please refer to the ‘Getting Started with SILQ’ category.

If you have already added in all your matters and contacts, follow the steps below to enter your initial trust deposits and establish a starting balance.

The thing to take note of is the total amount of your trust account that is stated on the trial balance is often lower than what is in the actual trust account. This is due to the fact that the trial balance does take into account unpresented cheques

Step 1

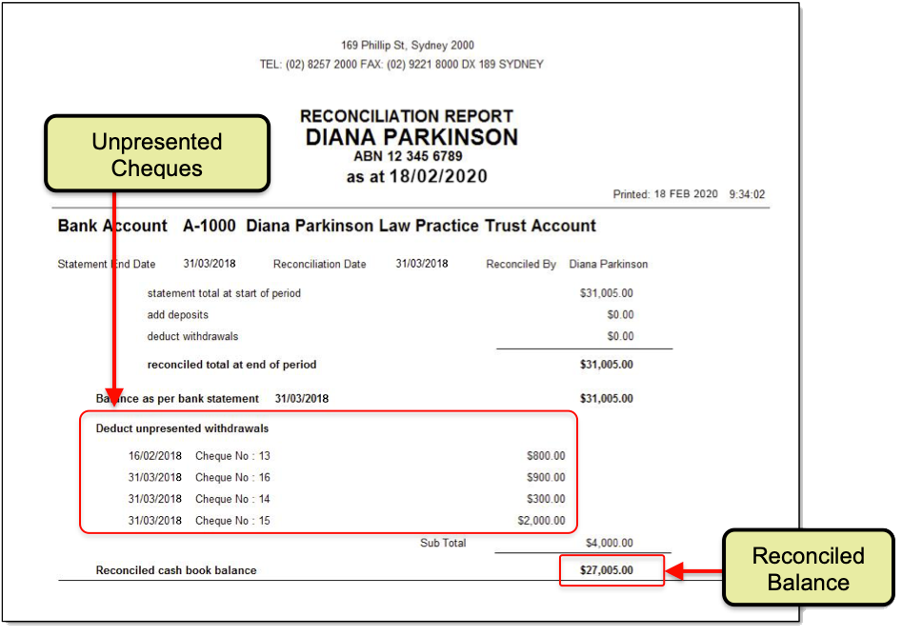

The first step is to print out a reconciliation report of your trust account from your existing system. This will display all your unpresented cheque withdrawals.

Reconciliation Report from existing system

Step 2

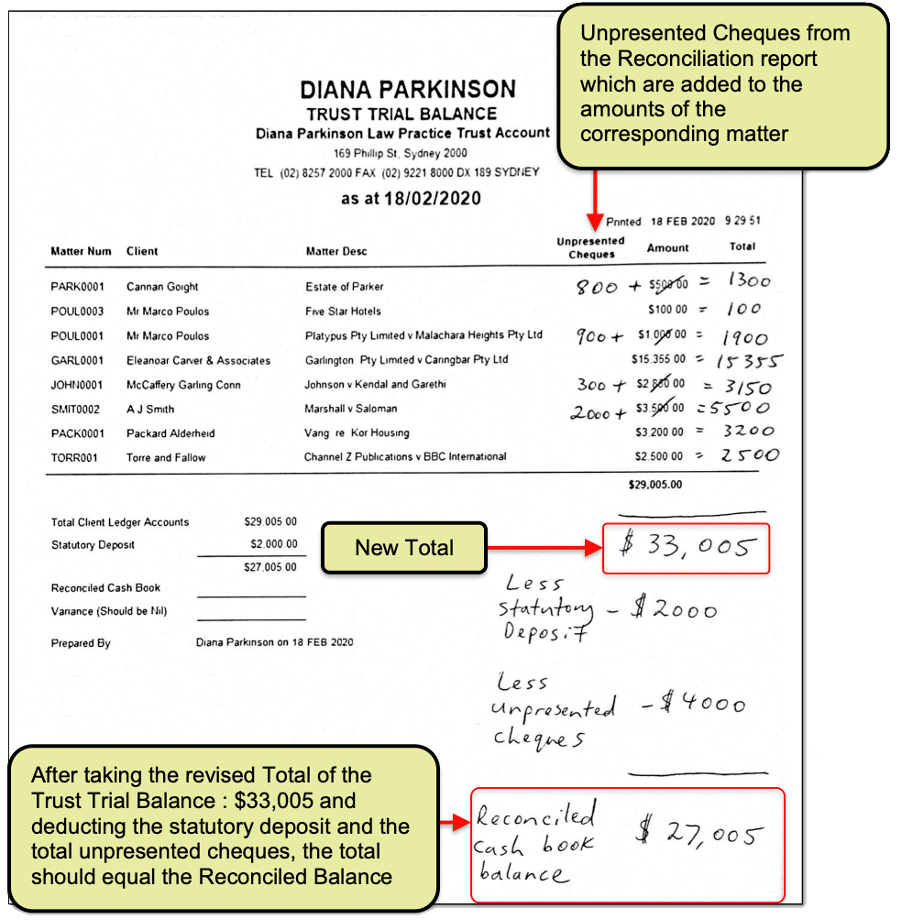

The second step is to print out a Trust Trial Balance report from your existing system. Then you need to add the value of the unpresented cheques from the Reconciliation Report to the corresponding matters balance on the Trust Trial Balance report you printed out.

Then you need to tally up the new balance. Once you have the new balance, you will then need to deduct any money that is in statutory deposit, as well as deduct the total of the unpresented cheques. You should then get the same reconciled cash book balance that you have on your reconciliation report.

Refer to the Reconciliation Report in Step 1, and then the Trust Trial Balance Report below to understand this process.

Step 3

The third step is to then enter the new balance you tallied up on the Trust Trial Balance report as a trust receipt into SILQ. In the example we will be using the total of $33,005 as indicated on the Trust Trial Balance report in step 2.

To do this, click the Trust Money button from the favourites bar, and then in the Top Toolbar click the Trust Receipt button.

.png?width=670&height=377&name=Initial%20trust%20deposit%201%20(1).png)

You will be presented with the Add Trust Receipt window. Enter the Total amount of the trust account balance into the Amount field. In our example that was $33,005. From the Payment Type drop down menu click EFT. Then click the Multiple matters tick box. This will activate the Multiple Matters tab.

Next referring to the trial balance report you printed out with the new tally of each matter, click on the Select Matter field. The Select Matter dialogue box will open up. Highlight the Matter you are putting the trust entry against and click on Select.

In the Received from field, enter ‘Initial Deposit'. Then enter a reason into the Reason field. Enter the Matter Amount (the adjusted total allowing for un-presented cheques) from your trial balance report, and then click on the Add button.

Repeat this process until you have entered all the Trust Receipts that are on your trial balance report.

You may have a trust entry for a particular matter that has a $0 balance and therefore it won’t appear on the trial balance report, but on the reconciliation report there is an unpresented cheque for that matter. This unpresented cheque entry will also need to be added into the Add Trust Receipt window.

Once you have entered all the trust receipts that are in your trial balance report, before you can click on the Save button to record this initial deposit, you need to enter an address into the Payor Address tab. This address would usually be the address of the person you received the money from in your trust account when you are adding a trust receipt.

As this is an initial deposit to create a starting balance in your trust account, you can just enter your own business address into the tab.

Step 4

The fourth step is to enter all the unpresented cheques into the system. Once you are in the Trust Money section, click the Trust Withdrawal button in the top tool bar.

You will be presented with the Add Trust Withdrawal window.

Enter each unpresented cheque separately into the Amount field until you have added the total of all the unpresented cheques. From the Payment Type drop down menu select the withdrawal type as EFT or Cheque.

Next referring to the reconciliation report you printed out with a list of the unpresented cheques, click on the Select Matter field. The Select Matter dialogue box will open up. Highlight the Matter you are putting the unpresented cheque against and click on Select.

In the Paid To field, enter the name of the company or person you paid this money to. Then enter a reason into the Reason field. Enter the Matter Amount from your trust reconciliation report, and then click on the Add button.

Repeat this process until you have entered all the Trust Withdrawals that are on your trust reconciliation report.

Then Click Save in the Add Trust Withdrawal dialogue box.

Step 5

If there is any money in Statutory deposit, you will need to enter it into SILQ. In our example there was $2000 in statutory deposit.

To do this, ensure you are in the Trust Money section, then click Statutory Deposit (to Law Society).

You will be presented with the Add Statutory Withdrawal window. Enter the Total amount of the statutory deposit into the Amount field. Then from the Payment Type drop down menu click EFT.

In the Paid To field, enter the name of the company you paid this money to. Then Click Save in the Add Statutory Withdrawal dialogue box.

Step 6

The last step is to run the Trial Balance report in SILQ to check that all the figures you have entered tally up.

To run the Trial Balance, click the Reports tab and in the Trust section click Trust Trial Balance.

The Trial Balance dialogue box will open up. Click the OK button and the SILQ will generate the report for you to print out and check.

If you have received a cheque for deposit and you haven’t banked it and entered it into your previous system, then process into SILQ as normal by using the Trust Receipt button.

If you have received a cheque and entered it into your previous system and not banked it yet, then you would need to subtract the total amount in the trust account for that matter based on the balance on the Trial balance report and then enter the new figure into SILQ.