How to work out commissions/bonuses paid to Fee Earners based on Invoices Paid

If your firm rewards your employees with a commission/bonus scheme you are able to work out exactly what is owing by using the Fee Earner Summary Report.

For firms that provide commission or bonus structures on top of salaries you are able to get this information from SILQ.

There is a lot of information you can get from this report, however for this article we will be focusing on using it to identify invoices that have been paid by your clients and the associated work done for a particular Fee Earner on those paid invoices.

The example we will look at is for Chris as a Fee Earner who has his 10% commissions paid monthly by his firm.

Under reports, choose the Fee Earner Summary Report

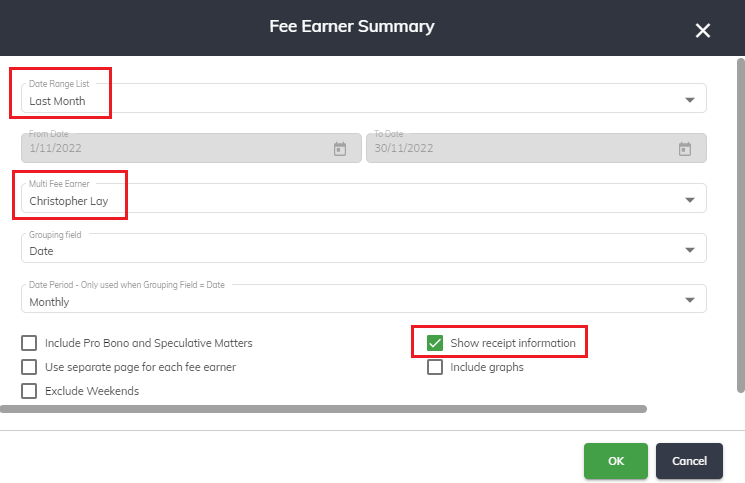

You will be presented with the below screen. What is really important here is to have last month as the date range, select the Fee Earner you are looking for (you could run the report for all fee earners if you prefer) and then check the Show receipt information checkbox.

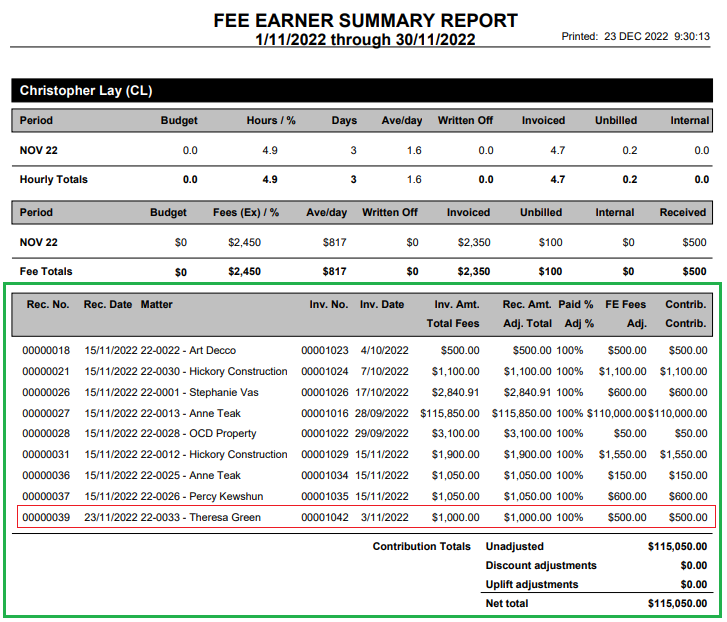

The report will render like this:

It is important that before running this report all receipts for the previous month are entered into the system to ensure you get the right net total.

For the purpose of answering this question, we will only be looking at the section in green which is the receipts section.

Each column means:

Rec. No. - This is the receipt number

Rec. Date - Date the receipt was entered into the system - when doing data entry this will default to todays date, but should be edited to reflect the date the money was actually received in your bank account

Matter - This field gives you both the matter number and the client name

Inv. No. - Invoice number

Inv. Date - Date of the invoice

Inv. Amt. / Total Fees. - If you have both fees and disbursements on an invoice SILQ will give you two lines in this column.

The top line will show the total Invoice Amount.

The second line will show the total fees for that invoice

Rec. Amt. / Adj. Total - If you have both fees and disbursements on an invoice SILQ will give you two lines in this column.

The top line will show the total received amount.

The second line will show the total received for fees only in relation to that invoice

Paid % / Adj. % - The paid % tells you how much of this invoice was paid by this particular receipt.

Fee Fees / Adj. - This field shows you for the particular fee earner selected, how much was charged for them specifically. For example, if you have a look at the line highlighted in red - the receipt from the 23rd of November shows that $1000 was received. However, in this column, the amount is $500. That is because there were multiple Fee Earner's on that invoice and as such Chris's contribution was $500.

Contribution - A mathematical calculation that takes the % paid x proportion of the invoice done by that Fee Earner x the invoice amount.

Example: You have an invoice that is $1000. The Fee Earner did $300. The client paid $600.

% paid = 60% (600/1000)

Proportion of the invoice done by that fee earner = 30% ($300/$1000)

Invoice amount = $1000

Therefore:

0.6 x 0.3 x $1000 = $180

QUESTION - who wears the discount

Unadjusted means that the company wears the discount/uplift

Net Total means the staff member wears the discount/uplift

The second line is for discounts or uplifts.

Example for a discounted invoice

$1200 was actually done on the invoice, however $200 was discounted, which means the invoice amount ended up being $1000. This Fee Earner did $300 worth of work on the invoice. The client paid $600.

% paid = 50% (600/1200)

Proportion of the invoice done by that fee earner = 25% ($300/$1200)

Fee Total (undiscounted Invoice amount) = $1200

Therefore the Net Total will now be:

0.5 x 0.25 x $1200 = $150

Example for an uplifted invoice

$800 was actually done on the invoice but it was uplifted by $200 to make the invoice amount $1000.

This Fee Earner did $300 of the work on the invoice.

The client paid $600.

% paid = 75% (600/800)

Proportion of the invoice done by that fee earner = 37.5% ($300/$800)

Fee Total (un-uplifted Invoice amount) = $800

0.75 x 0.375 x $800 = $225

What now?

Now that you now how the report works, in order to work out how much commission / bonus needs to be paid to Chris, you would:

Take the Net Total figure at the very bottom of the report and times that by the amount of commission Chris receives.

Therefore, Chris will need to be paid for the month of November, ontop of his normal salary:

$115,050 x 0.1 = $11,505

Please note, SILQ does not do this calculation for you, nor does it track the commissions paid. This report simply, quickly and easily, gives you the net figure you can base your calculation on.