How does the Unrecovered Disbursements report work?

A report that details all matter expenses / disbursements that have been invoiced, the invoice has been paid, but the disbursement has not yet been paid.

The Unrecovered Disbursements Report identifies disbursements that have already been invoiced to the client and fully paid, but where the corresponding third-party expense has not yet been paid by the firm.

In other words, the practice has received funds from the client to cover the disbursement, but the liability to the supplier is still outstanding. This report helps ensure that these funds are passed on to the appropriate party in a timely manner.

Why Use This Report?

-

Track disbursement liabilities: Know exactly which supplier payments are still outstanding, even though your client has already reimbursed the firm.

-

Avoid delays in supplier payments: Ensure timely payments to third parties and maintain positive supplier relationships.

-

Reduce risk of compliance issues: Stay on top of your obligations by making sure client-paid disbursements are promptly passed through.

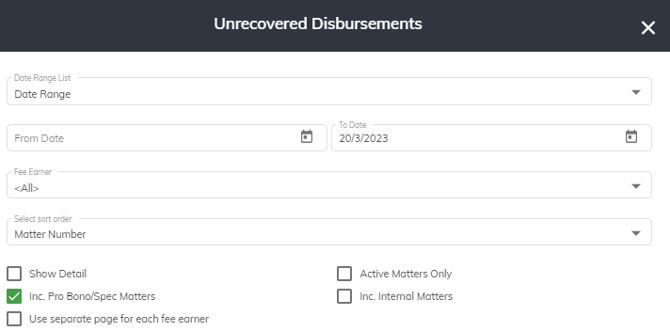

From the reports window, when you click on unrecovered disbursements you are presented with the below window. You choose your date range and also the sort order - either Matter Number, Matter Name, Client Name, Amount, Owner - Matter, Owner - Client, Primary FE - Matter or Primary FE - Client.

1. Date Range - This report is an 'As At' report. This means that technically it is not a date range, but more a Date To. It only shows transactions up until that day.

2. Select Fee Earner - If you leave this as 'All' it will show all transaction regardless of who the fee earner allocated to the expense is. However, if you choose a name from the dropdown, the report will only show you those outstanding expenses for matters where that person is the matter owner.

3. Select Sort Order - You are able to sort by:

a. Matter Number - Choosing this option will sort by Matter Number

b. Matter Name - Choosing this option will sort by the matter description

c. Client Name - Choosing this option will sort by the client of the matter

d. Amount - This will appear in descending order.

e. Owner - Matter - This will group by Owner and then sort by Matter.

f. Owner - Client - This will group by Owner and then sort by Client name.

g. Primary FE - Matter - This will group by Primary Fee Earner and then sort by Matter.

h. Primary FE - Client - This will group by Primary Fee Earner and then sort by Client name.

4. Show Detail - If this tick box in not ticked the report will only provide you with totals. Whereas if it is on you will have additional details such as date of expense, description, amount, invoice # etc.

5. Include Pro Bono/Spec Matters - This will include data for matters that are marked as Pro Bono and/or Speculative.

6. Use Separate page for each Fee Earner - This will provide a new page for each fee earner.

7. Active Matters only - This will only show unrecovered disbursements for active matters.

8. Inc. Internal Matters - This will only show unrecovered disbursement for matters that are not marked as Internal.

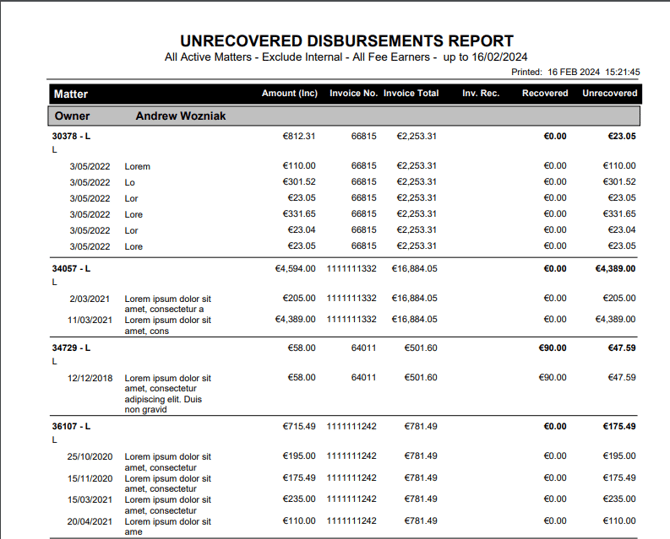

Once the report is generated the information you get (assuming you have the show detail checkbox ticked) is:

1. As At - the Date you chose

2. Owner - this will show the owner that the data has been grouped by

3. Date - The date of the disbursement

4. Description - the description of the disbursement

5. Amount Inc - The Amount inclusive of GST of the Disbursement.

6. Invoice No. - The invoice that the disbursement was billed on

7. Invoice Total - The total issued amount of the invoice

8. Inv. Rec. - The total amount that has been paid for the invoice

9. Recovered - This is a pro rata amount that reflects how much of the disbursement that has effectively been recovered. Eg if an invoice for $1000 has a $250 disbursement on it and it has received $400 in payment, then the recovered amount is $400/$1000 x $250 = $100.

10. Unrecovered - This is the total of the disbursement less the amount that has been recovered. In the above example, the unrecovered amount would be $250 - $100 = $150

Regularly reviewing the Unrecovered Disbursements Report helps your firm remain accountable for disbursement handling, avoid operational delays, and maintain financial clarity across client matters.