How does the Fee Earner Summary Report work?

The Fee Earner Summary report (and its variations) provides a breakdown of work completed by each fee earner or owner, showing both time recorded and dollar value.

The Fee Earner Summary report gives you a high-level overview of work completed by each fee earner or matter owner, based on both time recorded and the dollar value of that work. It’s a useful way to monitor productivity, assess performance, and identify billing contributions across your team.

There are multiple versions of this report available in SILQ — including the Owner Summary, Primary Fee Earner Summary, and Current Fee Earner Summary. Each version displays the same core data, but allows you to filter based on how the fee earner is linked to the matter (as the owner, original fee earner, or currently logged-in fee earner). This makes it easier to quickly locate the data most relevant to your workflow.

Why Use This Report?

- Monitor individual output: See how much time and value each fee earner has contributed across matters.

- Support performance reviews: Use the data to inform staff evaluations, bonuses, or billing targets.

- Understand team capacity: Identify high-performing staff, underutilised resources, or uneven work distribution.

Prior to generating the report you are able to customise the way the information is presented to you via the following options:

This report is is GST Exclusive.

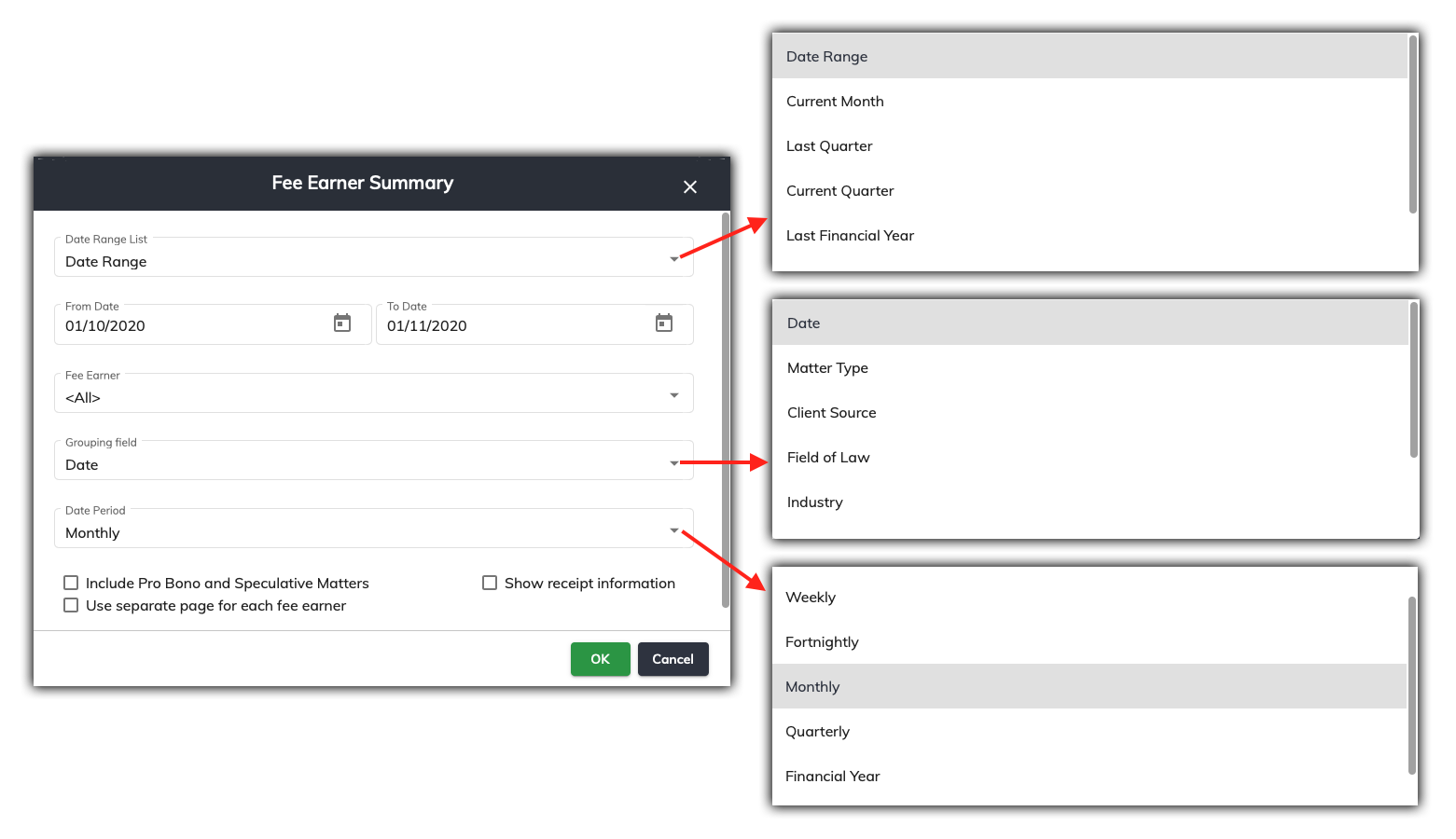

When you select to run a Fee Earners report from the Reports menu the following filter options are available:

-

Date Range - You can choose from any of the following

a. Choose a specific date range by selecting a from and to date.

b. Choose only the 'To Date' and it will give you everything (all time) up until that date.

c. From the dropdown you can choose pre-defined date ranges such as Current Financial Year or Last Month.

- Fee Earner - You can select ‘All’ Fee Earners to display on the report or individual Fee Earners from the drop down menu. You are able to select more than one fee earner.

- Grouping field - You are able to group by:

-

Date - this will group by the date the receipts were entered.

-

Matter Type - This will show receipts grouped by the matter types you have chosen (not to be confused with the matter classes).

-

Client Source - This will show receipts grouped by the client source you have chosen.

-

Field of Law - This will show receipts grouped by the field of law you have chosen.

-

Industry - This will show receipts grouped by the industry categories you have chosen.

- Matter Class - This will show receipts grouped matter classes.

- Owner - This will show receipts grouped by the owner of the matter (regardless of who the report is run for).

- Primary Fee Earner - This will show receipts grouped by the primary fee earner of the matter (regardless of who the report is run for).

-

- Date Period - This will only be available if you have chosen date as your grouping option. If you so, you are able to further group by daily, weekly, fortnightly etc.

- Include Pro Bono/Spec Matters - This will include receipts for matters that are marked as Pro Bono and/or Speculative if ticked.

- Show Receipt Information - Ticking this box will show you all of the receipts that make up the numbers in the totals above the receipts section.

- Include internal matters - receipts for matters that have been marked as internal in the matter class field will be included if this is ticked.

- Include Graphs - If ticked, SILQ will generate a graph at the end of the report to show you the total amount of receipts broken down by the period you selected in the date period dropdown as well as the fee earner.

- Exclude Weekends - this will exclude any WIP entered on Saturdays or Sundays.

The receipt section of the report focuses solely on the receipt date, therefore the WIP date irrelevant. All income will be allocated on the date payment is receipted, not when the work was actually done - for example, if you did work in month A, that work was invoiced in month B and the invoice was paid in month C, the work will appear on this report with the date range being month C.

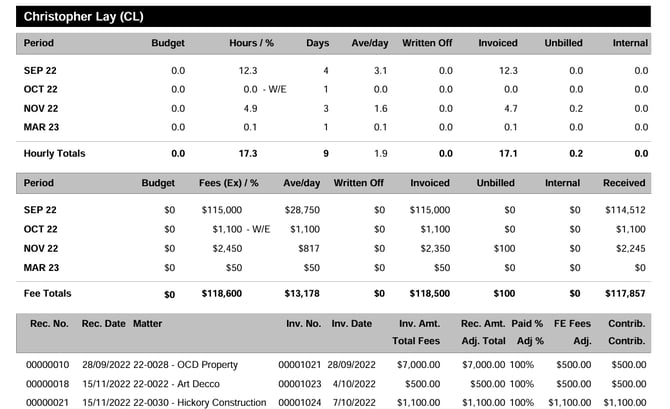

Once the report is generated, it will look like the below image (grouped by date & monthly):

It is split into three sections:

-

Hourly Summary (Top table)

-

Fee Summary (Middle table)

-

Receipts Breakdown (Bottom table)

Hourly Summary

This section summarises the fee earner’s hours across each selected period (e.g. month) based on the hours that have been receipted for that period.

- Period - Displays the relevant period you chose. In this example, the period chosen was month.

- Budget - Shows the hourly target or budget (if set) for that period. In this example, no hourly budgets were entered.

- Hours / % -

- Days - Indicates the number of days in the period where the fee earner recorded time entries. (This will not include Saturday or Sunday's if the exclude weekend box is ticked).

- Ave/day - The average number of hours worked per day (calculated from total hours ÷ days with entries).

- Written Off -

- Invoiced -

- Unbilled -

- Internal -

Fee Summary

This section reflects the dollar value of fees recorded, invoiced, and received by the fee earner in each period.

- Period - Displays the relevant period you chose. In this example, the period chosen was month.

- Budget - Shows the dollar target or budget (if set) for that period. In this example, no hourly budgets were entered.

- Fees (Ex)% -

- Ave/day - The average dollar value of fees recorded per working day where time was entered & receipted within the selected period.

- Written Off -

- Invoiced -

- Unbilled -

- Internal -

- Received -

Receipts Breakdown

- Rec. No. - The receipt number linked to the payment received.

- Rec. Date - The date the payment was received from the client.

- Matter - The matter & client name associated with the invoice and receipt.

- Inv. No. - The SILQ-generated invoice number.

- Inv. Date - The date the invoice was issued to the client.

- Inv. Amt. - The total amount of fees (excluding GST) invoiced to the client.

- Rec. Amt. -

- Paid % - The percentage of the invoice that was paid by the client (typically 100% if fully paid).

- FE Fees -

- Adj. -

- Contrib. - The actual contribution amount from that invoice that is credited to the fee earner.

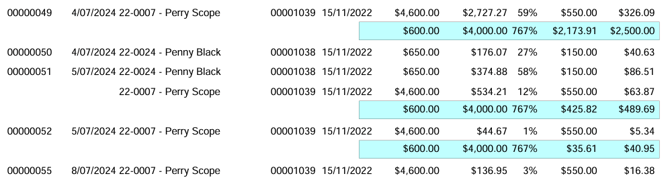

In certain circumstances, you will see a blue box on a second line under the receipts. These mainly relate to discounts & uplifts.

They will have the following fields:

- Total Fees -

- Adj. Total - The amount actually received and allocated to the invoice after any adjustments (e.g. partial payments, discounts).

- Adj % -

- Contrib.

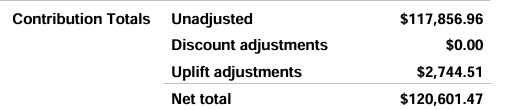

The bottom of the report has the below totals.

- Contribution Totals -

- Unadjusted -

- Discount adjustments -

- Uplift adjustments -

- Net total -

Here are some common questions about the Fee Earner Summary Report:

How to work out commissions/bonuses paid to Fee Earners based on Invoices Paid

Why does my Fee Earner report not match the General Ledger Detail - Income Accounts?