How does the Disbursement Summary report work?

The Disbursement Summary report provides a breakdown of all disbursements recorded over a selected date range. It helps your firm track how disbursements are being used, billed, and recovered — ensuring cost visibility and accurate client invoicing.

This report displays the total amount of Disbursement items entered for the specified date range as well as how much has been invoiced, received and how much of the displayed disbursement items are unbilled.

Why Use This Report?

-

Monitor disbursement activity: View how frequently each disbursement type is used and by whom.

-

Improve billing accuracy: Ensure disbursements are being recorded and billed consistently across the firm.

-

Recover costs effectively: Check that all third-party expenses are being tracked and passed on to clients where appropriate.

-

Support financial reporting: Gain insights into the role disbursements play in your firm’s revenue and matter profitability.

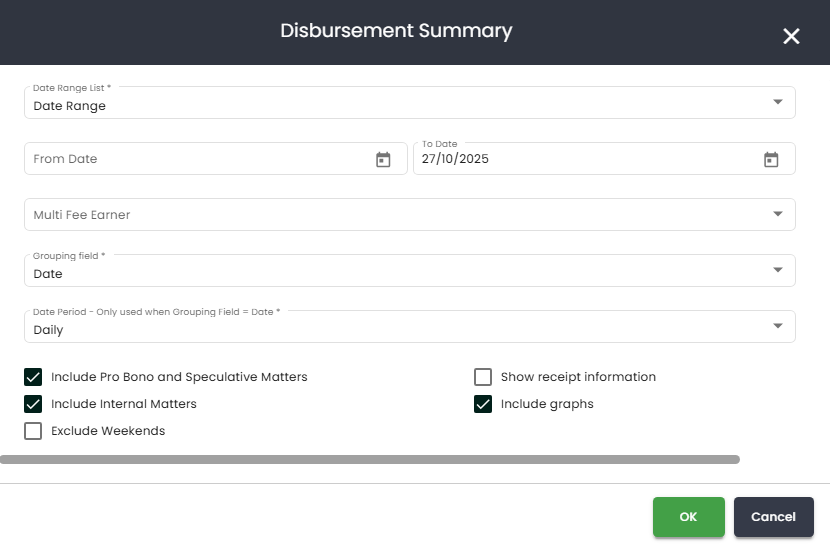

Prior to generating the report you are able to customise the way the information is presented to you via the following options:

- Date Range - You can choose from any of the following:

- Choose a specific date range by selecting a from and to date.

- Choose only the 'To Date' and it will give you everything (all time) up until that date.

- From the dropdown you can choose pre-defined date ranges such as Current Financial Year or Last Month.

- Fee Earner - If you leave this as 'All' it will show all disbursements regardless of who the Primary FE is. However, if you choose a name from the dropdown, the report will only show you those outstanding invoices where that person is the Primary FE.

-

Grouping Field - You are able to group by:

-

Date - this will group by the date the sundries are recorded and will not take into consideration what matter, client etc it is for when grouping.

-

Matter Type - This will show matters grouped by the matter types you have chosen (not to be confused with the matter classes)

-

Client Source - This will show matters grouped by the client source you have chosen

-

Field of Law - This will show matters grouped by the field of law you have chosen.

-

Industry - This will show matters grouped by the industry categories you have chosen.

-

- Date Period - You can choose to see the sundries in different date periods using the drop down.

- Include Pro Bono/Spec Matters - This will include sundries for matters that are marked as Pro Bono and/or Speculative if ticked.

- Show Receipt Information - Ticking this box will show you whether the sundry has been paid or is still outstanding.

- Include internal matters - matters that have been marked as internal in the matter class field.

- Include Graphs - If ticked, SILQ will generate a graph at the end of the report to show you the total amount of disbursements broken down by the period you selected in the date period dropdown.

- Exclude Weekends -

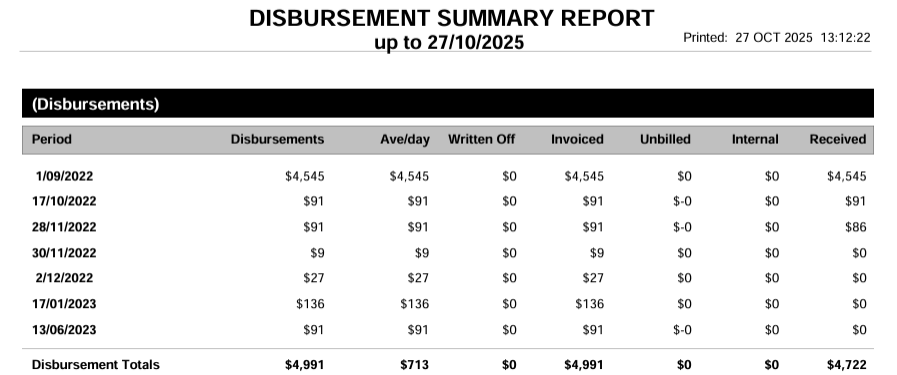

Once the report is generated, it will look like the below image (assuming you have not ticked to include graphs):

Below is an explanation of each column to help interpret the data:

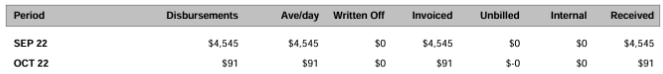

- Period - The period you have chosen in point 4 above. In the image above, daily has been chosen. If you were to choose monthly for example it would look like this:

- Disbursements - The total $ amount of disbursements recorded during the period.

- Ave/day -

- Written Off - The amount of the disbursements that have been written off.

- Invoiced - The amount of the disbursements that have been invoiced.

- Unbilled - The amount of the disbursements that remain unbilled.

- Internal - The amount of disbursements that are allocated to internal matters.

- Received - The total $ amount of the disbursements that have been repaid by the clients.

- Disbursement Totals - Tally of each column.