How do discounts and uplifts work in the receipts section of the Fee Earner Summary Report?

The receipts section Fee Earner Summary Report allows you to see if there are invoices which have discounts or uplifts associated.

To understand the receipts section of the Fee Earner Summary Report, you need to know how SILQ accounts for discounts and uplifts.

Firstly, they are defined as:

Discount - this discount is only the discount that is applied to fees. Any discounts applied to disbursements on an invoice are not recorded here as the Fee Earner Summary only shows you fee amounts on Invoices. Disbursements are not assigned to Fee Earners and are therefore excluded.

Uplift - an example of an uplift is if you have $800 worth of time recorded on the matter, however you have agreed with your client that they will be charged $1000. When you are creating the invoice, in the Discount/Increase tab, you can increase the invoice amount to $1000. Similar to above, this will only apply to fees.

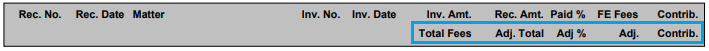

On the report, in the receipts section, you will see that there is a second line in the last few column headings:

The way these work are:

Contribution - A calculation that takes the % paid x proportion of the invoice done by that Fee Earner x the invoice amount. The final number will change dependant on whether you have a discount or uplift.

Example for a discounted invoice

$1200 was actually done on the invoice, however $200 was discounted, which means the invoice amount ended up being $1000. This Fee Earner did $300 worth of work on the invoice. The client paid $600.

% paid = 50% (600/1200)

Proportion of the invoice done by that fee earner = 25% ($300/$1200)

Fee Total (undiscounted Invoice amount) = $1200

Therefore the Net Total will now be:

0.5 x 0.25 x $1200 = $150

Example for an uplifted invoice

$800 was actually done on the invoice but it was uplifted by $200 to make the invoice amount $1000.

This Fee Earner did $300 of the work on the invoice.

The client paid $600.

% paid = 75% (600/800)

Proportion of the invoice done by that fee earner = 37.5% ($300/$800)

Fee Total (un-uplifted Invoice amount) = $800

0.75 x 0.375 x $800 = $225