Entering your ABN number and your default rates

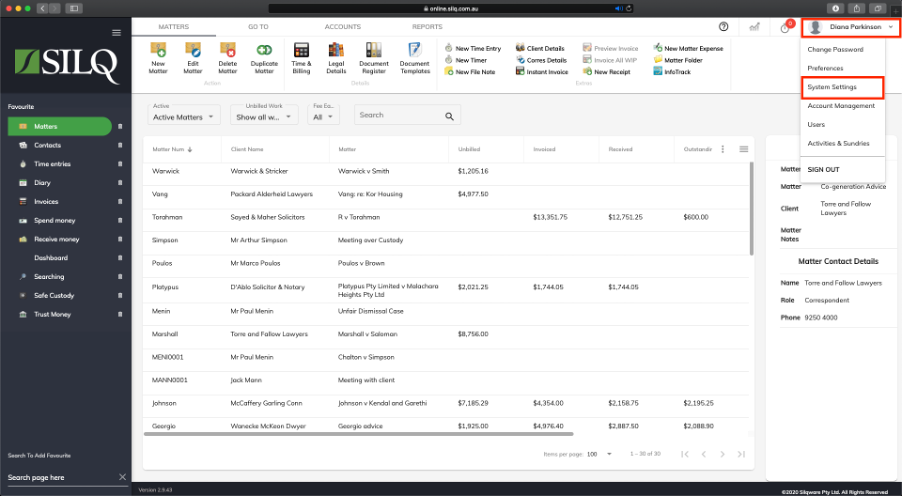

To enter or amend your ABN number and your default rates click on your name in the top right corner to view the drop down menu, then click System Settings.

Select the Business option on the left.

ABN

Enter your ABN in the ABN field. It is important to enter this so it comes out on your invoices.

Default rates

Enter your Hourly, Daily and Unit size rate in the corresponding fields. When a matter is first created it will use these settings as the default. (You can override them when you create a matter).

Due Date Offset

Enter your due date offset. This is how far into the future the due date should be set for an invoice.