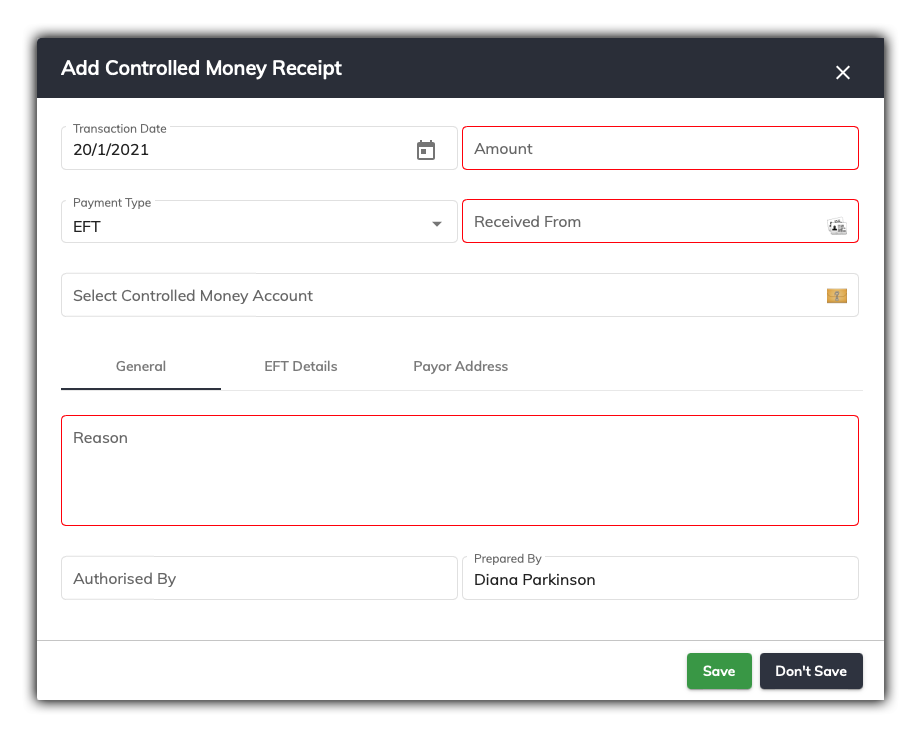

Add a Controlled Money receipt transaction

Once you have added the Controlled Money Account, you can now enter the controlled money receipt. This window has a number of fields that need to be filled in, which will allow you to put in significant details about the nature of the monies being received and held in trust, as well as instructions from the client.

Whilst not going into the Trust Account, it is a Controlled Money Receipt, which is entered similarly to a Trust Receipt.

The following information has been entered in the example above for a controlled money receipt.

-

Transaction Date: Will auto-fill

-

Amount: Enter the amount of money you wish to enter into the trust account

-

Payment Type: Options are Cheque, EFT, Cash or Credit Card

-

Matter: Click on the matter icon and link to an existing matter

-

Payor: This is the party that has issued the money to your firm

-

In the General Tab, complete the Reason: This free form field allows you to type in

FREEFORM the reason as to why this money is being deposited to the Trust Account

-

Authorised by: (this field allows you to enter how authorised this transaction – usually the responsible solicitor)

-

Prepared by: (this field will auto-fill, but will only need to be changed if not correct)

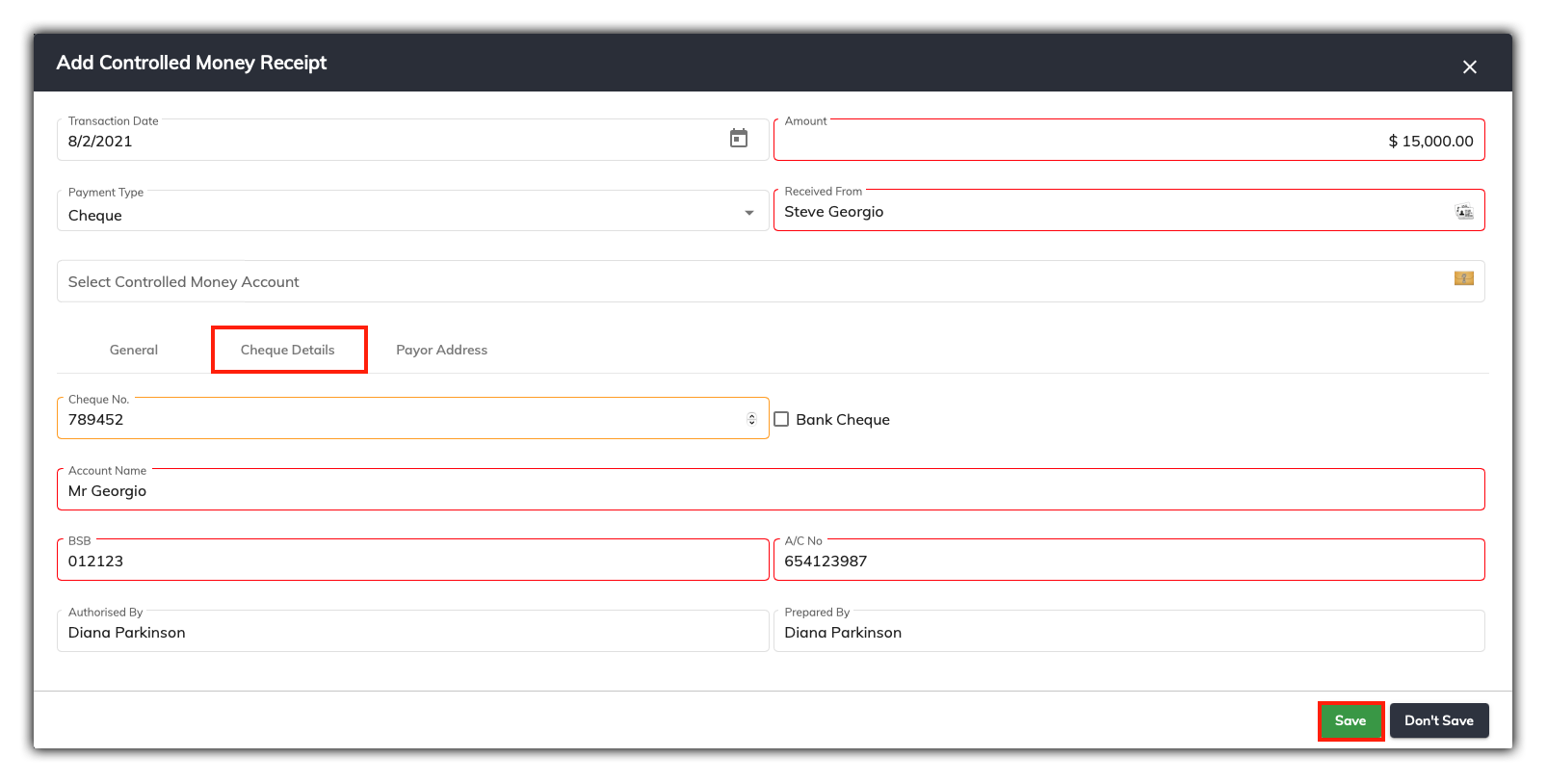

Entering Cheque details for a Controlled Money Receipt

Selecting the Cheque payment type, displays the payment details tab Cheque Details. In this section, therefore recording how you received the Controlled Money from the client.

SILQ allows you to enter all the information in regards to the cheque that was banked. Mandatory fields will be Red and suggested fields will be in Orange. Refer to the example above.

-

Cheque No: Allows to you manually enter a cheque number

-

Bank Cheque: Tick this field if the cheque received was issued as a bank cheque

-

Account Name: The name of the account that the cheque received came from

-

BSB: BSB bank details of the payer

-

A/C No: The bank account number that the cheque is being issued from

If you selected a payment type of either EFT or Cash, to see how to fill in these details, refer to this article.

Once you have entered all the details into the trust withdrawal window, click Save.

You will be presented Controlled Money Receipt as a PDF saved in Matter Folder. You can choose to print this if it’s required